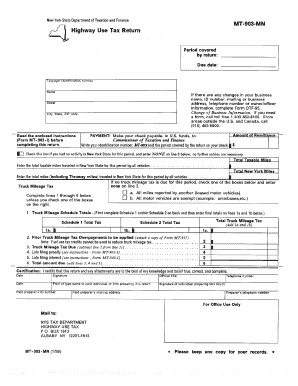

ny highway use tax form mt-903

MT-903-MN Highway Use Tax. Click on the variant to select if.

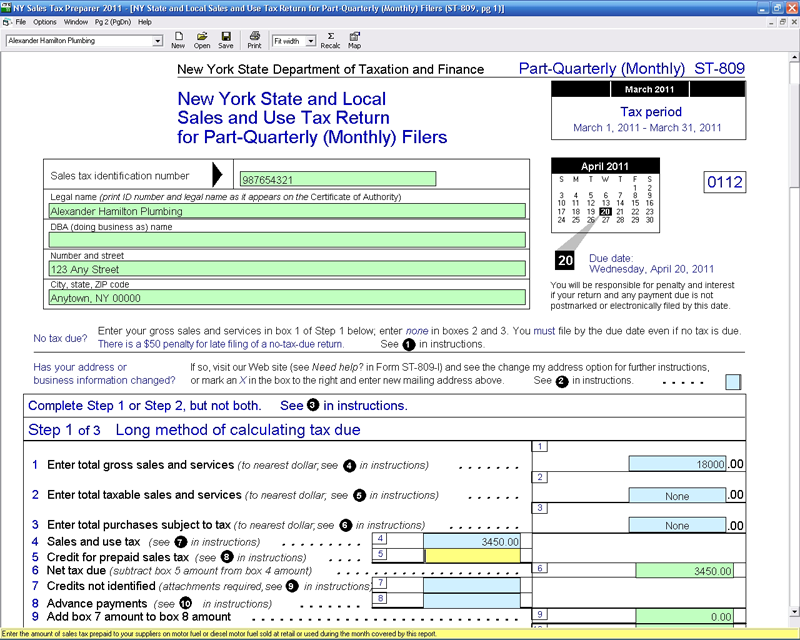

Ny Sales Tax Preparer Cfs Tax Software Inc Software For Tax Professionals

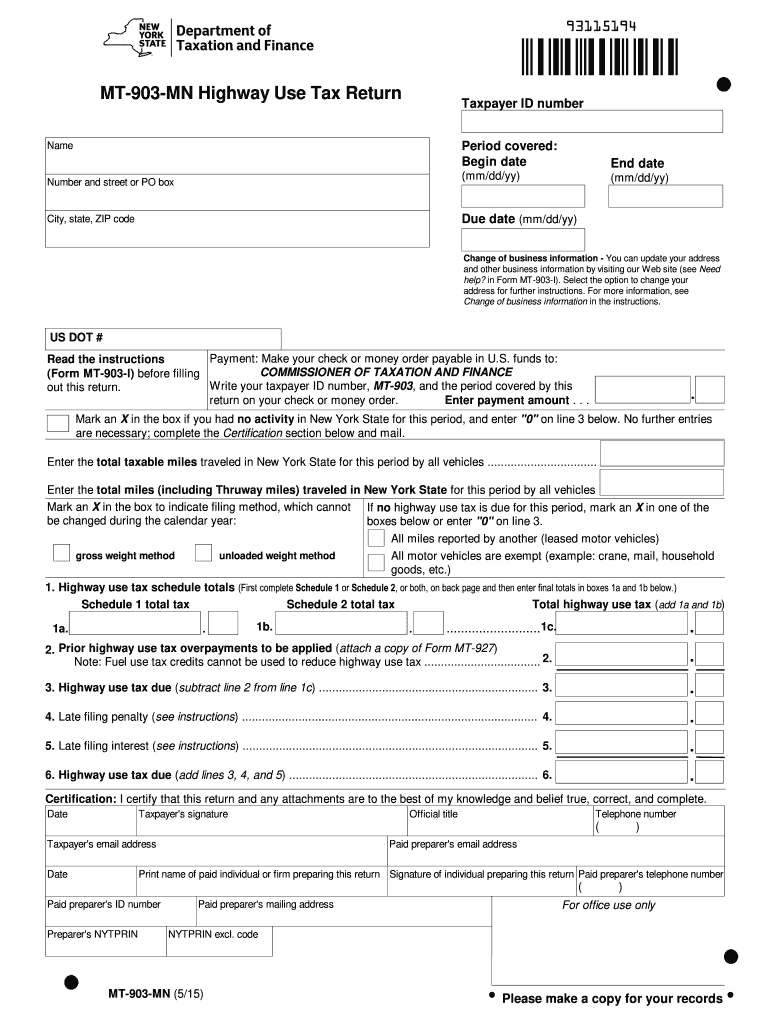

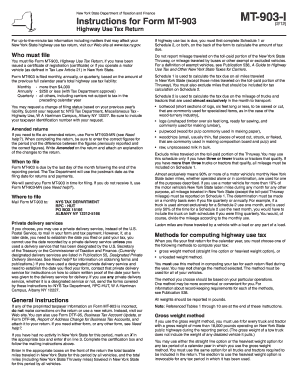

The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

. These tables are to be used for the period january 1 2001 through march 31 2001. Be sure to use the proper tables for your reporting method. The best way to file NY DTF MT-903-I fast and easy.

Mail Form MT-903 to NYS. Vehicle as defined in Tax Law Article 21 in New York State. 122 legal name mailing address number and street or.

View the PDF template in the editor. The Tax Department will use the postmark date as the filing date for returns and payments. To compute the tax due on the schedules below see the Tax rate tables for highway use tax on page 4 of Form MT-903-IInstructions for Form MT-903.

Refer to the highlighted fillable fields. See Tax Bulletin An In See more. Form MT-903 is filed monthly annually or quarterly based on the amount of the previous full calendar year s total highway use tax liability Monthly - more than 4 000 Annually - 250 or less.

Form MT-903 is due by the last day of the month following the end of the reporting period. If you have any questions please see Need help. Monthly - more than 4000 Annually - 250.

MT-903-MN Highway Use Tax Return New York On average this form takes 43 minutes to complete. Highway use tax - Schedule 1 Do not report Thruway mileage or. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

Form MT903 is filed monthly annually or quarterly based on the amount of the previous full calendar years total highway. Be sure to use the proper tables for. Note Referenced Tables 1 through 10 are at the end of these instructions.

This is where to insert your details. Ny Highway Use Tax Form Mt-903. Form MT-903 is filed monthly quarterly or annually based on the amount of the previous full year s total truck mileage tax and fuel use tax liability.

The Tax Department will use the postmark date as the filing date for returns and payments.

Amy Chiarelli Controller The Patriot Organization Inc Linkedin

Federal Register Corporate Average Fuel Economy Standards For Model Years 2024 2026 Passenger Cars And Light Trucks

Mt 903 Mn Fill Online Printable Fillable Blank Pdffiller

Mt 903 Mn Highway Use Tax Return Mt 903 Mn Highway Use Tax Return Pdf Pdf4pro

2015 2022 Form Ny Dtf Mt 903 Mn Fill Online Printable Fillable Blank Pdffiller

Form Mt 903 Mn Fillable Highway Use Tax Return Manual Version

Form Dtf 406 Claim For Highway Use Tax Hut Refund

New York Highway Use Tax Registration Things You Need To Know

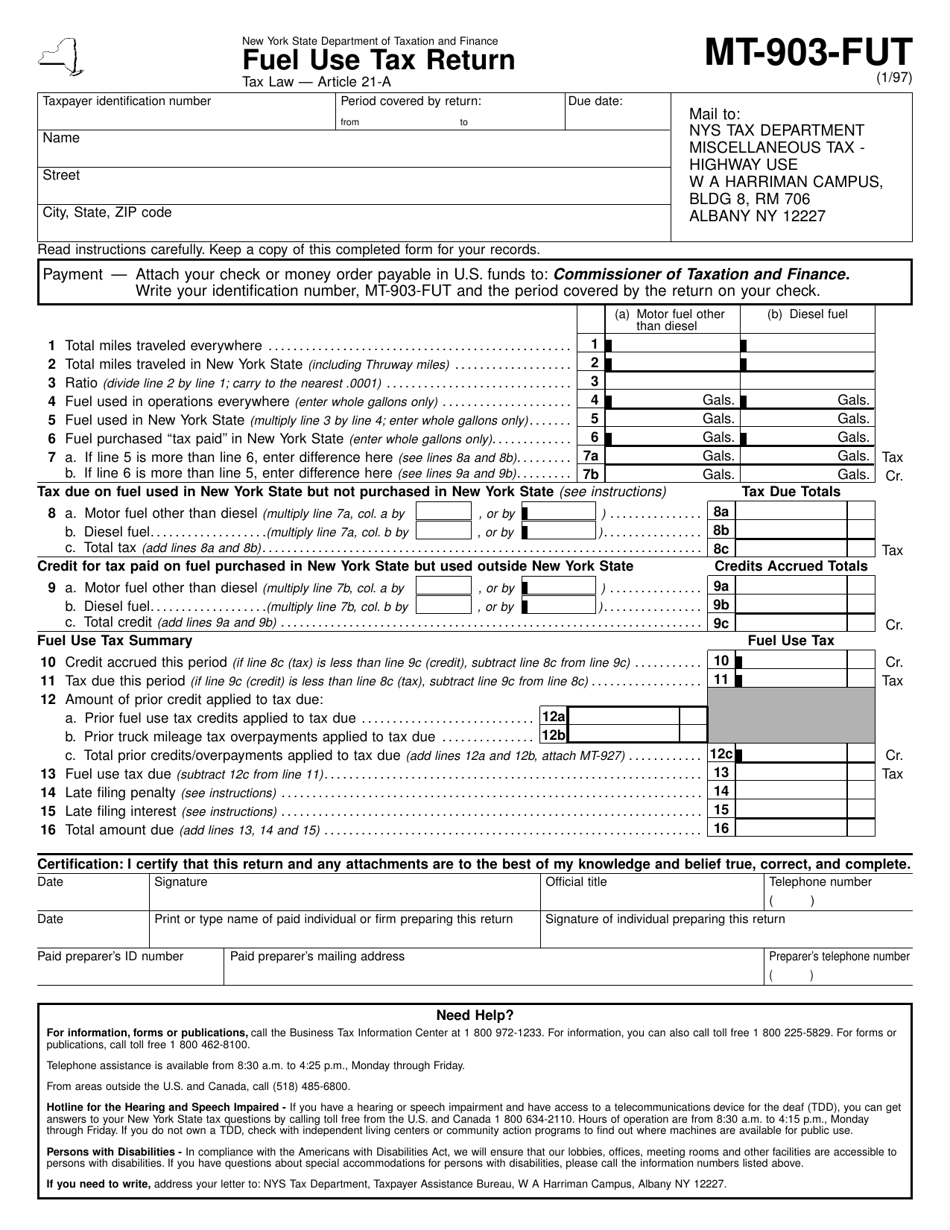

Form Mt 903 Fut Download Printable Pdf Or Fill Online Fuel Use Tax Return New York Templateroller

Ny Highway Use Tax Hut Explained Youtube

International Fuel Tax Agreement Ifta A Guide For New York State Carriers

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Fill Free Fillable Form 93115194 Mt 903 Mn Highway Use Tax Return New York Pdf Form

Mt 903 Form Fill Out And Sign Printable Pdf Template Signnow